Apple Pay to launch in the UK next month

After much success in the U.S, Apple Pay will be launching in the UK next month, offering a simpler, faster and more secure way for you to pay in more than 250,000 locations.

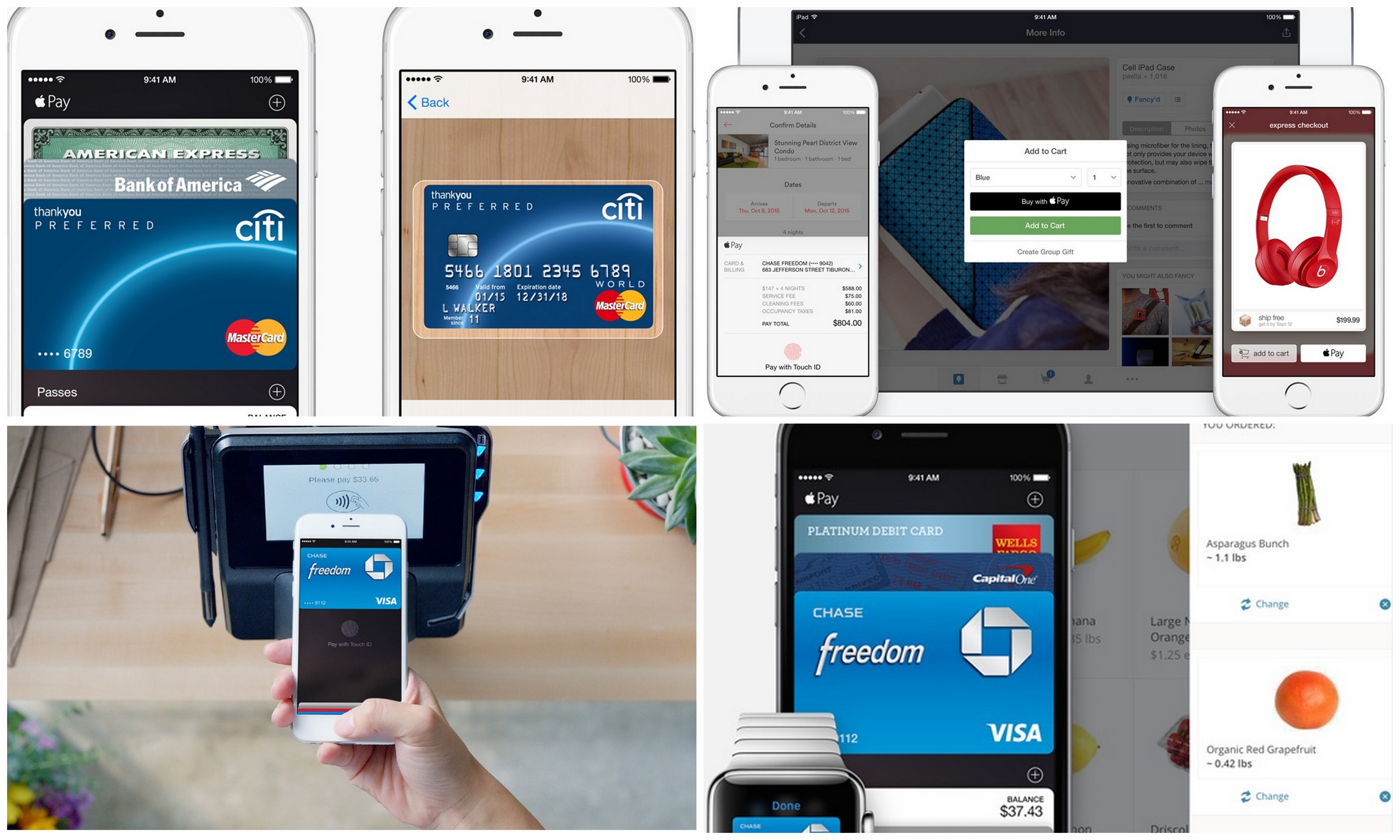

How Apple Pay works:

Apple Pay works using the Near-Field Communication (NFC) chip found in your Apple iPhone and/or Apple iWatch – similar to the contactless payments on a credit or debit card. However, with Apple, an additional layer of security has been added to the process, called ‘tokenisation’. This gives you a unique “token” for making a payment that does not disclose any details. Ensuring the card details you have stored will never be passed onto the retailer.

How to use Apple Pay:

On your iPhone: Hold your iPhone near the contactless reader with your finger on the Touch ID.

On your iWatch: Double click the side button and hold the display up to the contactless reader.

Compatible Apple devices:

iPhone 6 and 6 Plus – In Apps and In Stores.

iWatch paired with: iPhone 5, iPhone 5C, iPhone 5S, iPhone 6 and iPhone 6 Plus – In Stores.

iPad Air 2 and iPad Mini 3 – In Apps.

Apple pay is supported by more than 70% of credit and debit providers in the UK

Apple Pay supports your credit and debit cards from:

American Express, MasterCard, Visa Europe, HSBC, NatWest, Nationwide Building Society, Royal Bank of Scotland, Santander, Ulster Bank and First Direct.

Banks set to follow in future months:

Bank of Scotland, Coutts, Halifax, Lloyds Bank, MBNA, M&S Bank, TBS Bank.

Unfortunately, Barclays has not signed up for the service.

Participating retailers include:

Marks and Spencer’s, Lidl, Post Office, Liberty London, McDonalds, Boots, Costa, Waitrose, PRET, BP, Subway, Wagamama, Spar, KFC, Nando’s, New Look, Starbucks, Dune and JD.

Transport for London has also signed up, allowing payment of underground and bus services using your Apple iPhone or iWatch.

Payments will be capped to £20, a similar limit to existing contactless payments, however this cap is due to rise to £30 in September.